- Global Market News

- Posts

- Powell’s Warning: No Rate Cuts & CFPB Under Fire – What It Means for You

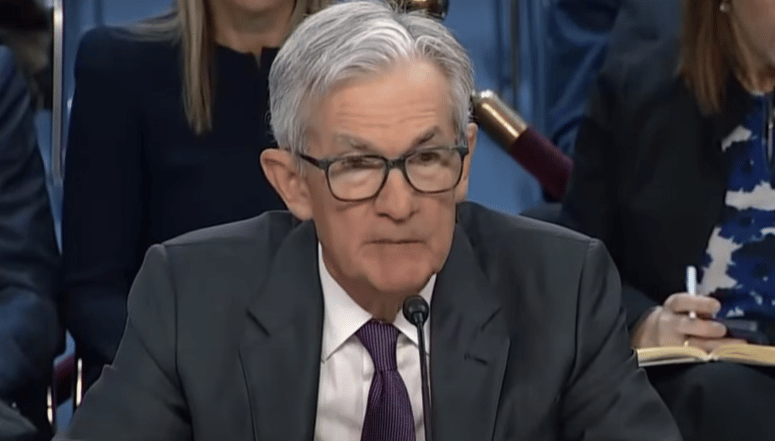

Powell’s Warning: No Rate Cuts & CFPB Under Fire – What It Means for You

Your mortgage, loans, and credit card rates could stay high longer than expected. Powell’s latest testimony explains why.

Higher Borrowing Costs & Financial Regulation Battles – Here’s What You Need to Know

Federal Reserve Chair Jerome Powell just testified before the Senate, and his message was clear: there’s no rush to cut interest rates.

That means mortgages, credit cards, and loans could stay expensive for longer. But that’s not all—lawmakers also clashed over the Consumer Financial Protection Bureau (CFPB) and its role in financial oversight.

With borrowing costs high and financial regulation in the spotlight, how will this affect your money?

Smarter Investing Starts with Smarter News

The Daily Upside helps 1M+ investors cut through the noise with expert insights. Get clear, concise, actually useful financial news. Smarter investing starts in your inbox—subscribe free.

Know what you own, and know why you own it.

-Peter Lynch